Rural Matters Deep Dive: Understanding Property Taxes

As harvest season begins across Iowa, it’s time for farmers to hit the fields and prepare for the semi-annual property tax payment deadline on September 30th (with the second payment due on March 31st). Property taxes are a significant source of revenue for local governments, funding essential services like public schools, infrastructure, and emergency services. However, many farmers, businesses, and homeowners may not fully understand how property taxes are assessed or where their money goes. In this week’s Rural Matters Deep Dive, we’re breaking down the property tax system to give you a clearer picture.

The property tax cycle in Iowa starts with the property value assessment conducted by local assessors. For most properties, such as residential, commercial, and industrial, the assessed value is based on market value. However, agricultural property is assessed differently.In Iowa, the productivity value is used instead of the market value for agricultural land. This means the land’s value is based on its income-generating ability through farming activities. Factors such as soil quality, crop yields, and commodity prices over five years determine the productivity value.

Once property values are assessed, the next step is determining the property tax levy. Here’s how the process works:

Iowa property taxes are paid in two installments:

The county treasurer is responsible for collecting taxes and distributing them based on budgets and levy rates set by local governments. Here’s how the funds are generally allocated:

Iowa offers several property tax exemptions and credits to reduce the tax burden for eligible property owners. Here are a few common ones:

For a complete list of exemptions and eligibility requirements, visit your local assessor’s office or the Iowa Department of Revenue website.

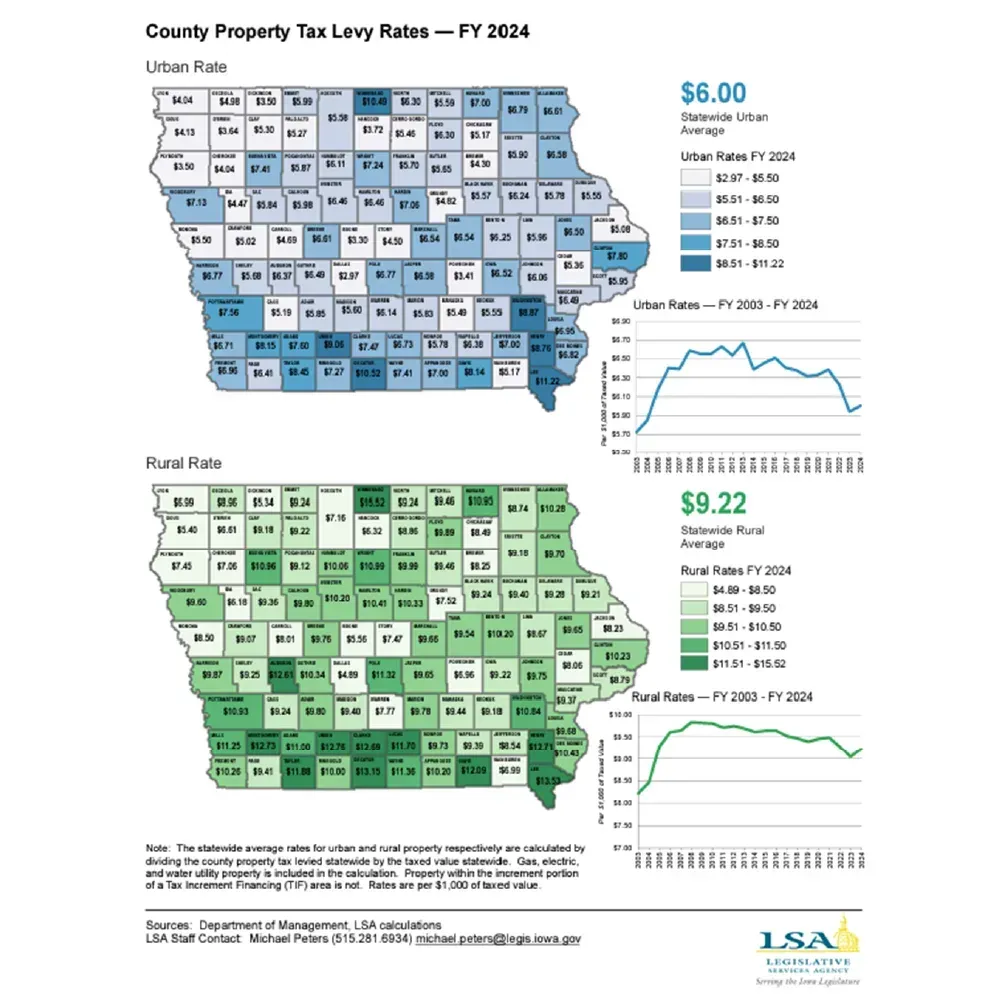

In Iowa, property tax rates vary widely depending on the county and whether you live in a rural or urban area. Understanding these differences can help property owners see how their taxes are used. Here’s a chart from the Iowa Legislative Services Agency that compares county property tax rates across the state.

Understanding property taxes in Iowa allows property owners, especially farmers, to navigate the system better and take advantage of available exemptions and credits. If you have questions about your property taxes, it’s a good idea to consult with your local assessor or county treasurer. Got any suggestions for future Rural Matters Deep Dives? Reach out to Elizabeth at Elizabeth.Thompson@landus.ag.